Medical Insurance

- Please visit the State Health Plan website for full details on the choice of plans

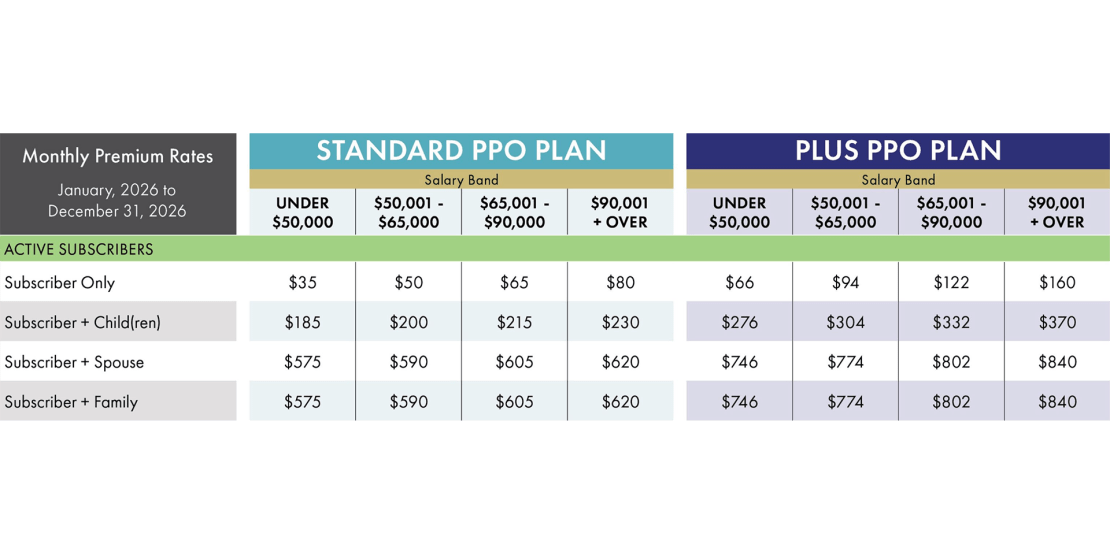

- Choice of Standard PPO or Plus PPO Plan

Coverage Costs (per month, as of January 1, 2026):

Notes:

- If your employment contract is for less than 12 months, contact the Payroll Office for monthly rates.

- If you are actively employed and you or your dependent(s) are Medicare eligible, the State Health Plan is the primary insurer, and the Non-Medicare rates apply. An exception to this would be if you or your dependent(s) are Medicare primary due to end of stage renal disease (ESRD).

- The College share for Active Subscribers is $742.04/month.

NC Teachers’ and State Employees’ Retirement Benefits

- Teachers’ and State Employees’ Retirement Handbook

- Enrollment is automatic and also mandatory for full-time employees

- Employee contributions are deducted on a pre-tax basis equaling 6% of salary

- The College contribution is 24.67%

- Death benefit of not less than $25,000 or more than $50,000 based on the employees’ salary is available through the NC Retirement System after the employee has worked for the state for one year

- Disability benefits for short-term and long-term disability available (service credit conditions apply)

Voluntary Dental Insurance Provided by MetLife

- Once enrolled, you may take advantage of online self-service capabilities with MyBenefits. Click here to register for MetLife voluntary dental insurance self-service.

- $25 deductible per individual; $75 deductible per family, per calendar year. (Applies to basic restorative and major restorative only.)

- Preventive Care covered at 100% (includes exams, x-rays, and cleanings twice per calendar year)

- Basic care at 80% (includes extractions, fillings, root canals, and other procedures)

- Major & restorative care covered at 50% (includes crowns, dentures, bridges, oral surgery and other procedures)

- Orthodontia procedures for dependent children under age 19 coverage: $500 per child lifetime maximum (Dependent children are eligible for all other benefits coverage until their 26th birthday.)

- Maximum benefit of $1,750 per person per calendar year

Premiums are paid for by employee:

| COVERAGE | COST TO EMPLOYEE |

|---|---|

| Employee Only | $43.31/month |

| Employee & Spouse | $93.50/month |

| Employee & Child(ren) | $111.31/month |

| Family | $152.55/month |

Voluntary Vision Provided by EyeMed

- Enroll at EyeMed

- Preferred Provider Organization with many in-network providers to choose from

- Two plans to choose from: Low Plan (hardware only) or High Plan (full service)

Cost to Employee

| TIER | LOW PLAN | HIGH PLAN |

|---|---|---|

| Employee Only | $6.28/month | $8.56/month |

| Employee + 1 | $10.94/month | $15.05/month |

| Employee + Family | $18.77/month | $25.76/month |

Low Plan Coverage

Low Plan Frequencies:

- Lenses every 12 months

- Frames every 24 months

- Contacts every 12 months

| BENEFIT | IN NETWORK | OUT OF NETWORK |

|---|---|---|

| Eye Exam | _ | _ |

| Frames – Retail Value | $150; 20% off balance over $150 | $105 |

| Lenses (per pair) | Single, bifocal, trifocal, and lenticular: paid in full after $15 copay | Single - $40 Bifocal - $55 Trifocal or Lenticular - $90 |

| Contact Lenses (in lieu of glasses) | $150 (medically necessary contacts paid in full) | $105 (up to $210 for medically necessary contacts) |

High Plan Coverage

High Plan Frequencies:

- Exam every 12 months

- Lenses every 12 months

- Frames every 24 months

- Contacts every 12 months

| BENEFIT | IN NETWORK | OUT OF NETWORK |

|---|---|---|

| Eye Exam | $15 copay | Up to $40 copay |

| Frames – Retail Value | $150; 20% off balance over $150 | $105 |

| Lenses (per pair) | Single, bifocal, trifocal, and lenticular: paid in full after $15 copay | Single - $40 Bifocal - $55 Trifocal or Lenticular - $90 |

| Contact Lenses (in lieu of glasses) | $150 includes standard fitting paid in full; up to $40 allowance for specialty fitting (medically necessary contacts paid in full) | $105 allowance for contacts; $40 allowance for standard and specialty fitting; up to $210 for medically necessary contacts) |

Medical & Childcare Flexible Spending Accounts

- Plan year begins January 1 and ends December 31

- Set money aside on pre-tax basis to pay for planned expenses

- Medical flexible spending account ($3,300/year maximum)

- Childcare Reimbursement ($7,500/year maximum)

- Account access available online for monitoring balance

Deferred Compensation

- NC 401(k) Plan and NC 457 Plan – Available through the North Carolina Total Retirement Plans to supplement retirement; plans are employee funded

Tricare Supplement

- Contact Selman and Company

- Coverage for military retirees and eligible dependents

- Pays secondary to Tricare and reimburses member’s cost shares, deductibles, and excess charges

| COVERAGE | COST TO EMPLOYEE |

|---|---|

| Employee Only | $60.50/month |

| Employee & Spouse | $119.50/month |

| Employee & Child(ren) | $119.50/month |

| Family | $160.50/month |

Employee Assistance Plan (EAP)

- Contact MYgroup

- Available to address personal or work-related challenges

- Confidential and free to employees

- Help is available 24/7/365 at 800-633-3353

Annual Leave

Earned according to years of employment*/**:

| SERVICE | ANNUAL LEAVE |

|---|---|

| 0–5 Years | (9 hours, 20 minutes/month) 14 days |

| 5–10 Years | (11 hours, 20 minutes/month) 17 days |

| 10–15 Years | (13 hours, 20 minutes/month) 20 days |

| 15–20 Years | (15 hours, 20 minutes/month) 23 days |

| 20+ Years | (17 hours, 20 minutes/month) 26 days |

*Faculty do not earn annual leave

**Annual leave in excess of 240 hours as of June 30 will be converted to sick leave

Sick Leave

- Employees earn 8 hours per month

- Sick leave is cumulative indefinitely

Petty Leave

- Non-exempt employees earn 2 hours of petty leave per month

Group Term Life Insurance

- Craven Community College purchases a $20,000 group term life insurance policy for each full-time and part-time regular employee working at least 25 hours per week

- You can purchase additional amounts on yourself, spouse, and/or children at group rates

Pet Insurance

- Available through Nationwide for cats, dogs, birds, and certain exotic pets

- For rate information and to enroll, visit Nationwide's designated webpage for Craven Community College

Other Optional Benefits

- State Employees' Credit Union Membership (SECU) eligibility

- State Employees Association of North Carolina (SEANC) eligibility

- Cancer, Critical Care, Accident, Short-Term Disability Income, Medical Bridge, and Life Insurance through Pierce Group Benefits

Contact Information

Human Resources

Brock Administration Building, Suite 234

New Bern Campus

252-638-2492

252-672-7516 (Fax)